2025 Property taxes are due on July 2, 2025

The due date for Property taxes, including eligible Home Owner Grant (HOG), is 5:00pm, July 2, 2025. Any payments for outstanding current taxes or Home Owner Grant received after the due date will be subject to a 10% penalty.

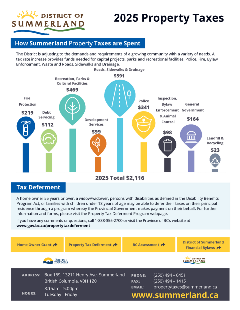

Download and print the 2025 Property Tax Insert

The property tax insert provides property owners with useful and easy to read information, including: how property taxes are spent, where the money goes and how to claim the Home Owner Grant.

How and where to pay your property taxes:

- In person at the Municipal Hall, located at 13211 Henry Avenue

- Deposited in our secure drop box, located at the main entrance of the Municipal Hall

- Mailed to: Box 159, Summerland BC V0H 1Z0. Post-dated cheques are accepted. * Note that Postmarks are not considered proof of payment date *

- Payments can also be made by internet or telephone banking. If paying online please enter the three digit jurisdiction number 325 followed by your eight digit roll number. This will be eleven digits all together without any spaces or decimals.

Making a payment Online by Credit Card:

The District of Summerland is now accepting online payments with select credit cards (Visa and Mastercard through the secure OptionPay System (with third party fees). Note that all processing fees are charges by OptionPay and are not received by the municipality. Please allow 3 - 5 business days for processing.

Click here to PAY BY CREDIT CARD .

Click here to PAY BY CREDIT CARD .

View the OptionPay Tiered Rate Table

Payments Currently Accepted through OptionPay for the following:

- Utilities

- Property Taxes

- Accounts Receivables (Invoices)

- Tickets/Fines

- Licences (Business/Pet Licences)

- Permits (Building/Electrical)

Paying in person at the Municipal Hall

The District accepts cash, cheque or debit payments.

Credit cards are now accepted on a user pay basis through

Property Taxes Paid by Mortgage Company

If your property taxes are paid through your mortgage company you still have to claim the Homeowner Grant yourself. This needs to be claimed through the Province of BC website. Payments and Grants must be received and claimed by the due date to avoid the 10% penalty.

HOME OWNER GRANT INFORMATION

Summerland residents are no longer able to apply for the home owner grant through municipal hall. Everyone must now apply directly to the province using a new online system that’s easy to use and will process applications faster.

The District of Summerland's Property Taxation Department is responsible for administering and processing the collection of property taxes within the District. Property taxation is the single most important source of municipal revenue. Collected taxes fund District of Summerland operations, including the fire and police departments, recreation facilities, development services, animal control, road construction and many other services.

Property Tax Statements are mailed to residents by the end of May annually. If you do not receive the property tax statement by mid-June, contact the Property Tax Department at 250-494-6451 or email us at propertytaxes@summerland.ca.

Property owners are responsible for payment of property taxes whether or not a Property Tax Statement is received.

The property tax rates, along with the property classification and assessed value of your property, are used to determine the amount of your property taxes. Property taxes cannot be appealed.

CLAIM YOUR HOME OWNER GRANT - CLICK HERE

You can obtain more information about the Home Owner Grant at Municipal Hall or at the Provincial Government website.

Property Tax Pre-Authorized Payment Plan

Would you like to set money aside for your next year's property taxes? The Property Tax Pre-Authorized Prepayment Plan could be for you! This program offers a convenient method of paying your taxes in advance. The Plan begins in August and continues through June. When you join the prepayment plan, your monthly installment will be automatically deducted from your bank account. Simple interest will be paid on your prepayments. Application forms are available at the Municipal Hall and online.

Property Tax Preauthorization Application form

Property Tax Pre-Authorized Payment Plan Information Sheet

If you are currently enrolled in the pre-payment plan, you will be notified in early August of your new deduction amount based on an estimate of next year's taxes.

Property Tax Deferment Program

You may qualify for this program if you are age 55 or older, widowed, or in receipt of a disability allowance under the Disability Benefits Program Act. You must have and maintain a minimum equity of 25% of the current assessed value of your home determined by BC Assessment.

Property Tax Deferments

Families with Children - Property Tax Deferment Program

You may qualify for this program if you are a homeowner financially supporting a dependent child under 18.

Property Tax Deferments

Property Assessment

The Property Assessment Roll is prepared by BC Assessment.

For more information on assessment issues in the Penticton region, please contact:

BC Assessment

300-1631 Dickson Avenue

Kelowna BC V1Y 0B5

Phone: 1-866-825-8322

Fax: 1-855-995-6209

www.bcassessment.ca

Contact Information

If you have any questions regarding Property Taxes, please contact the Finance Department at 250-494-6451, by fax at 250-494-1415, or by e-mail at

finance@summerland.ca.